The Importance of Reading in Childhood

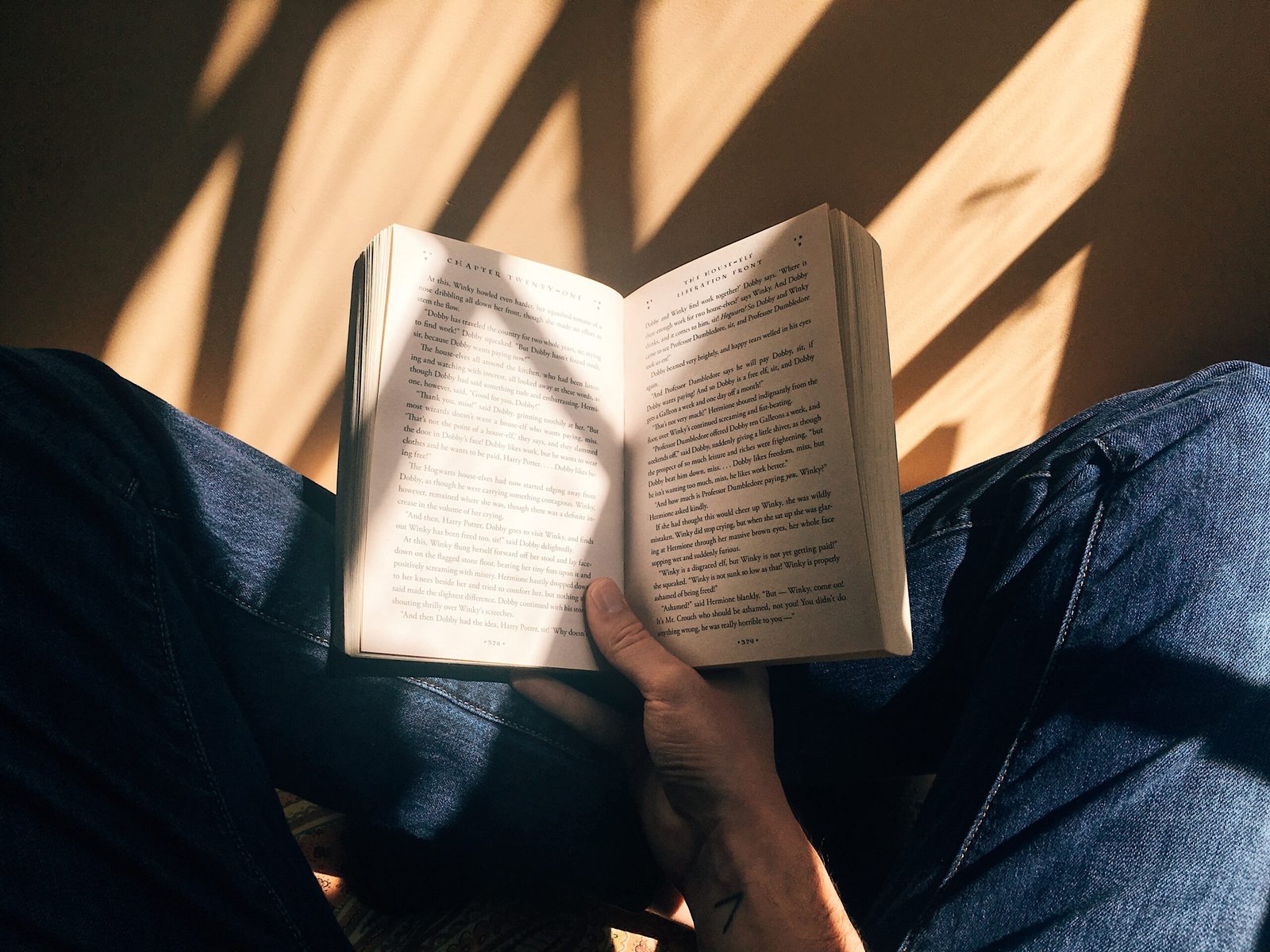

Reading is a fundamental skill that plays a crucial role in a child’s development. It not only enhances their language and cognitive abilities but also fosters imagination, creativity, and empathy. Cultivating a love for reading in children sets them on a path of lifelong learning and exploration. One way to create a nurturing reading environment is by setting up a reading nook.

Creating the Perfect Reading Nook

A reading nook is a dedicated space where children can escape into the world of books and stories. It should be a cozy and inviting area that sparks their curiosity and imagination. Here are some tips on how to create the perfect reading nook:

1. Choose a Comfortable Space

Find a quiet and comfortable corner in your home where your child can relax and focus on reading. It can be a small area in their bedroom, a cozy corner in the living room, or even a spot in the backyard.

2. Provide Ample Lighting

Good lighting is essential for reading. Ensure that the reading nook has enough natural light during the day. If that’s not possible, invest in a good reading lamp that provides adequate brightness without straining the eyes.

3. Make it Cozy

Add soft cushions, bean bags, or a comfortable chair to make the reading nook cozy and inviting. Children should feel relaxed and at ease while spending time there.

4. Stock it with Books

A reading nook is incomplete without a wide selection of books. Fill it with age-appropriate books that cater to your child’s interests. Include a mix of fiction, non-fiction, and picture books to cater to their varied tastes.

5. Personalize the Space

Encourage your child to personalize their reading nook by adding their favorite stuffed animals, posters, or artwork. This will make the space feel special and uniquely theirs.

Encouraging Reading Habits

Once the reading nook is set up, it’s important to encourage regular reading habits in children. Here are some ways to do so:

1. Lead by Example

Show your child that reading is a valuable and enjoyable activity by reading in their presence. Let them see you immersed in a book and share your reading experiences with them.

2. Read Together

Set aside dedicated time for shared reading. Take turns reading aloud or choose a book that you can read together. This not only strengthens the bond between you and your child but also creates positive associations with reading.

3. Visit the Library

Take regular trips to the library and let your child explore different genres and authors. Encourage them to choose books that pique their interest and allow them to develop their own reading preferences.

4. Make Reading a Habit

Set aside a specific time each day for reading. It could be before bedtime or during a quiet afternoon. Consistency is key in establishing a reading routine.

5. Celebrate Achievements

Recognize and celebrate your child’s reading milestones. Whether it’s finishing a challenging book or reading a certain number of pages, praise their efforts and make them feel proud of their accomplishments.

In Conclusion

Creating a reading nook and fostering a love for reading in children is a gift that will last a lifetime. By providing a cozy and inviting space, stocking it with books, and encouraging regular reading habits, you can help cultivate a lifelong passion for reading in your child. So, set up that reading nook today and watch your child embark on countless adventures through the pages of a book!